Who We Are

Hear from RPW President Joe DeNoyior about our commitment to help you thrive.

How We Help

Whether you want to promote better outcomes for your workforce or pursue your individual financial planning goals, we can help.

Retirement

We help you attract and retain employees with innovative retirement plan solutions

Private Wealth

Our mission is to help you define where you want to go and help you get there

Financial Wellness

We strive to help your employee reduce financial stress at work and pursue better outcomes

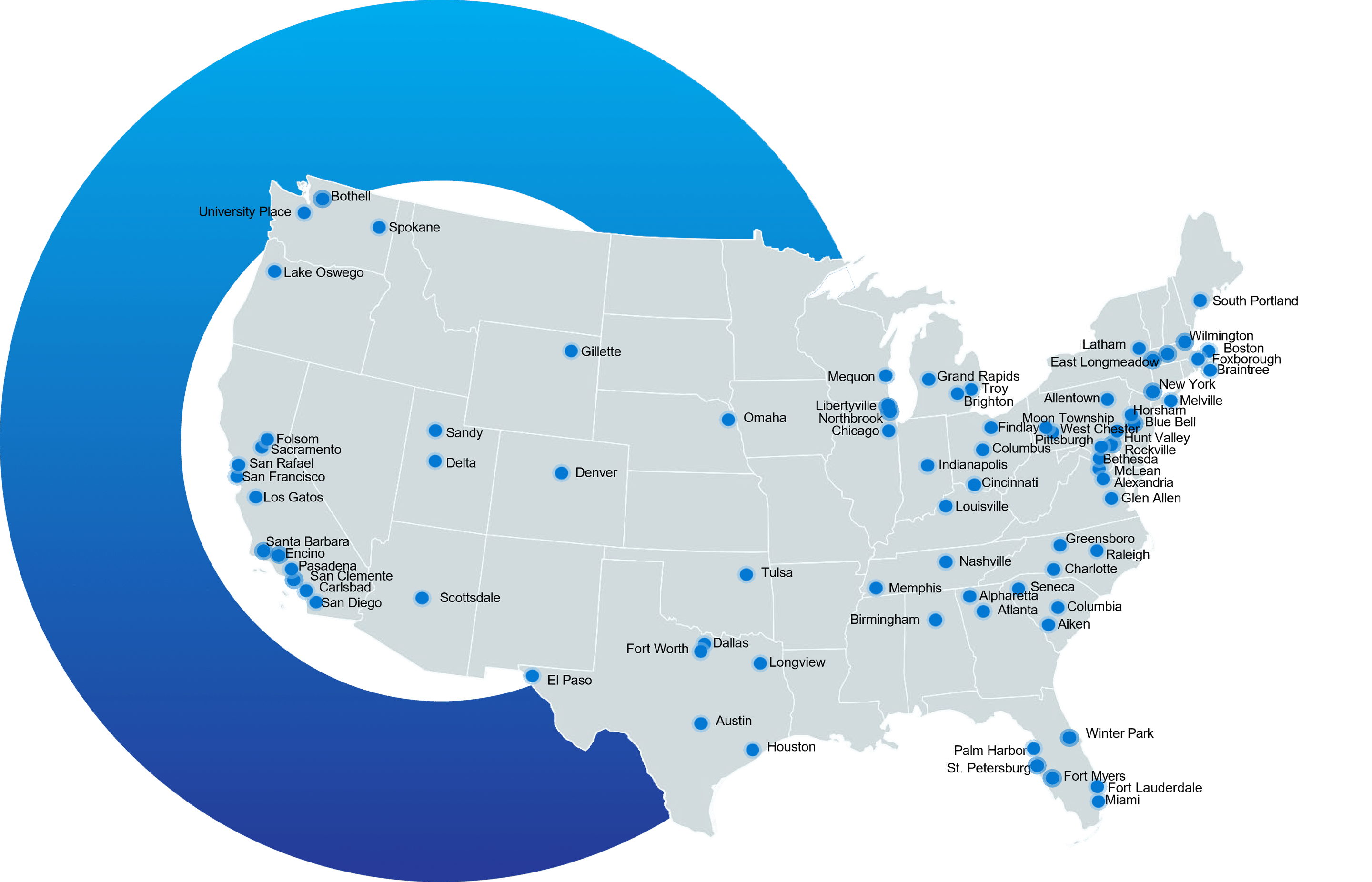

National Reach. Local Leadership.

Nationwide coverage wherever you reside

$178B+

Retirement plan and private wealth assets under advisement*

10,000+

Retirement plans under advisement

Who We Serve

Tailored Solutions to Meet Your Unique Needs.

Individuals and Families

Mass Affluent and High Net Worth

Organizations

For-Profit companies, Not-for-profit organizations, and governmental entities

Employees

Workforce and Executives

Stay Up to Date with the Latest Insights

[Video] Q4 2025 Economic and Market Commentary

Economic Deck In this quarterly review, Brian Collins, Chief Investment...

January 2026 Roundtable Summary

HUB Retirement & Private Wealth recently...

Market Commentary: December 2025 Recap

Don’t StopFleetwood MacDon't Stop Don’t stop thinking about tomorrow / Don’t...

Let’s take your next financial step together.

Your journey to financial success begins here.

![[Video] Q4 2025 Economic and Market Commentary](https://hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)