May Recap and June Outlook

The debt ceiling negotiations dominated headlines throughout the month. By month end, the deal was hammered out and on its way through Congress to end up on the president’s desk before “X-Date” when the Treasury ran out of money.

The negotiations suspended the debt ceiling until January 2025, and both sides agreed to flat non-defense government spending in 2024 and a cap of 1% in spending increases on government spending in fiscal year 2025.

Throughout the month, the markets focused on the debt ceiling negotiations and the likely impact to government spending – or at least the increased uncertainty around what spending would be. At the end of the month, the FOMC minutes from the early May meeting were released. The minutes reveal a divided Fed, with some committee members believing that “further policy firming after this meeting may not be necessary,” while another group still believes that the return of inflation to the targeted 2% level will continue to be unacceptably slow, requiring additional rate hikes.

With the debt ceiling out of the way, attention has now returned to the Fed and what will transpire at the mid-June meeting. It’s widely expected that the Fed will “skip” a rate hike in order to allow time for the hikes already enacted to continue to work through the economy.

The additional impact of lower government spending and increased Treasury issuance remains largely unknown.

Let’s get into the data:

- 12-month CPI was 4.9% in March. The Bureau of Labor Statistics reported a monthly increase of 0.4%.

- GDP increased at a rate of 1.3% in the Q1. The Bureau of Economic Analysis (BEA) reported the number, which was revised upward from the first estimate of 1.1% growth in the first quarter

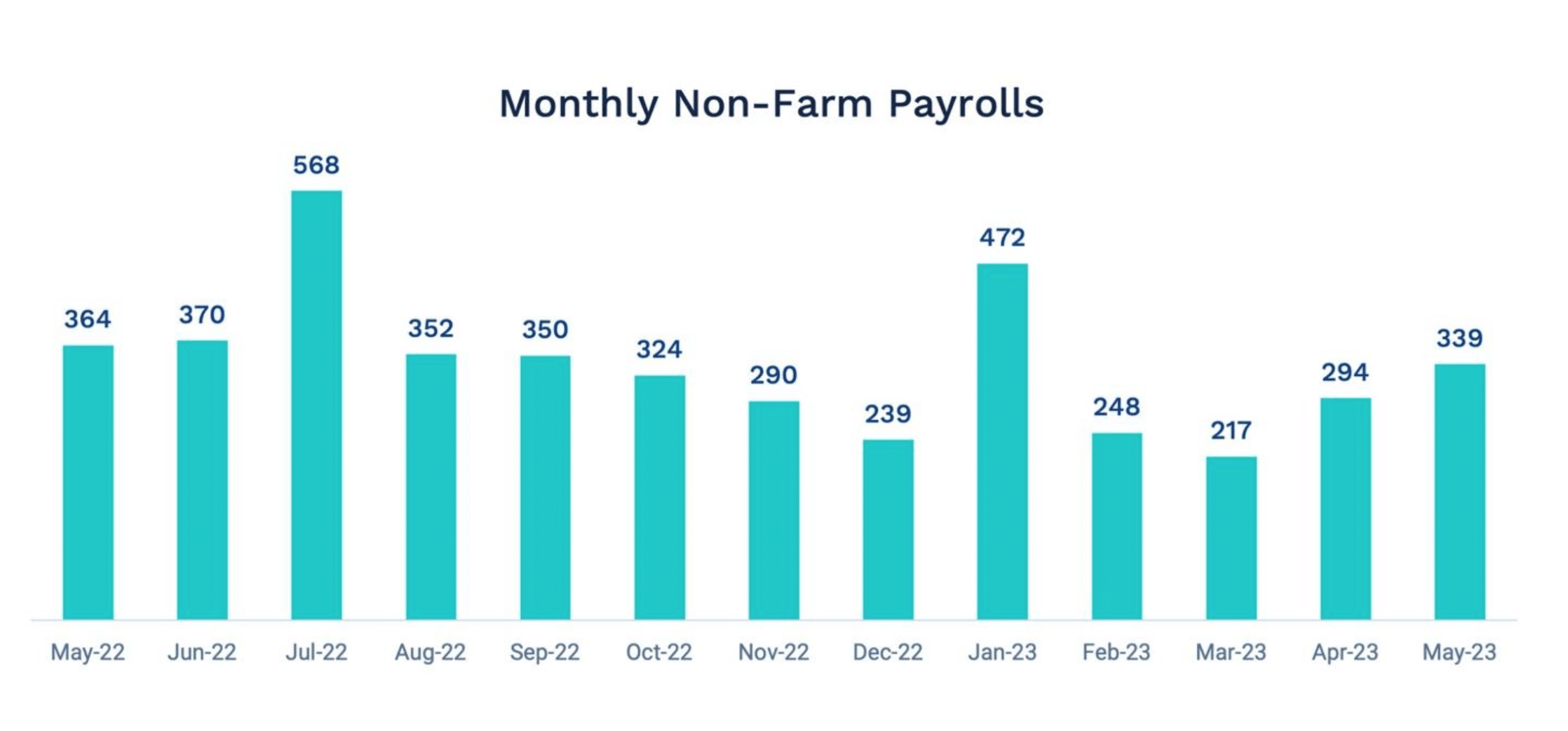

- May non-farm payrolls of 339,000 brought the heat. The Bureau of Labor Statistics report was the highest monthly number since January

What Does the Data Add Up To?

The Fed is trying diligently to tamp down economic growth to control inflation, but recent progress has slowed, and changes are incremental. GDP was revised upwards during the month, and the labor market remains very strong. Consumer spending, the driver of the economy, is still relatively stable, given the increased impacts of continued inflation, higher interest rates, and depleted savings.

The FOMC minutes show that “almost all participants” agree on two things: tighter credit conditions resulting from turmoil in the banking sector may create more risks to growth than anticipated in the rate hikes already enacted, and inflation is the key driver of policy, as it remains well above target is decreasing very slowly.

What does that mean for the future path of rate hikes? The June meeting will likely be a “skip,” meaning the Fed will leave rates unchanged. It’s a skip and not a pause because the optionality of going back to rate increases if necessary is still on the table.

The Fed now has two more inputs to stack against the continued strength of the labor market and still growing GDP. Lower government spending will negatively impact GDP, and a massive Treasury bill issuance will further tighten the money supply.

Chart of the Month: The Labor Market Continues to Steam Forward

Despite ten consecutive rate hikes totaling almost 500 basis points, the labor market is still strong.

Source: U.S. Bureau of Labor Statistics

Equity Markets in May

- The S&P 500 was up 0.25%

- The Dow Jones Industrial Average fell 3.49%

- The S&P MidCap 400 decreased 3.36%

- The S&P SmallCap 600 dropped 1.94%

Source: S&P. All performance as of May 31, 2023

Only three of the eleven S&P 500 sectors were up, with Information Technology adding 9.29% for the month. Lack of dispersion is back in 2023, with the top eight issues accounting for all of the year-to-date gain of the index.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.64%, up slightly from 3.43% in April, as the debt ceiling negotiations resulted in a deal at month end. The 30-year U.S. Treasury ended May at 3.85%. The Bloomberg U.S. Aggregate Bond Index returned -1.08%.

The Smart Investor

With the debt ceiling resolved, the Treasury can refill its coffers, and government can go back to “normal” spending.

What about the consumer? With the path of the Fed still undetermined, higher interest rates seem likely to continue. If you’re moving money from cash to money markets or CDs, that’s a good thing. If you’re carrying a credit card balance or trying to make a big purchase, you’ll borrow for, that’s not good news.

What should investors focus on?

- With higher volatility likely, ensuring your portfolio is diversified can help

- We’ve seen progress on inflation, but it’s not ending soon. Plan spending accordingly

- Inflation has some benefits: HSA limits have been bumped up. This is a triple-tax-advantaged way to save for the biggest cost in retirement – healthcare

This year marks a bright line between the old environment of low rates and rising tides lifting all boats. Planning ahead, ensuring that you are staying on track, and knowing what your options are is the best way to keep your financial goals moving toward you.