July Recap and August Outlook

Data releases in July told a story of a stronger-than-expected economy, with headline CPI falling and the labor market remaining robust.

The doom-and-gloom scenario of an all-but-inevitable recession seemed to be replaced by something that looked like optimism around the prospect of a soft landing. Even Fed Chairman Powell, in the press conference after the FOMC meeting in mid-July, softened his language by referencing a “noticeable slowdown,” as compared to the previous language on recession.

The Fed rate increase of 25 basis points, to a target range of 5.25%-5.50%, was widely anticipated and brought the Fed Funds rate to the highest level in 22 years. Whether this will be the last rate increase or not is still an open question. The next Fed meeting is in September, and Powell indicated that the Fed will be assessing the data and raised the possibility of holding steady on rates.

Despite a strong labor market, there are other factors that may weigh on the economy. Lower government spending resulting from the early summer negotiations on the debt ceiling, and the resumption of mandatory student loan repayments will begin to make an impact.

Headline inflation, including volatile food and energy, is getting much closer to the Fed’s target of 2%, but core inflation – which excludes food and energy – is still high, and this number is stickier.

Let’s get into the data:

- 2Q GDP grew at a rate of 2.4%. The Bureau of Economic Analysis released the “advance” estimate, which was higher than market expectations of 1.8%.

- 12-month CPI was 3.0% in June. The Bureau of Labor Statistics reported a 4.8% rate for core CPI, excluding food and energy.

- Consumer confidence continued to expand.The Conference Board reported that the Consumer Confidence Index rose to 117.0 in July, up from 110.1 in June.

- Consumers don’t appear to be expecting a recession. The Consumer Expectations Index rose to 88.3, from 80.0 in June. A reading of 80 or below has historically signaled a recession in the next year.

- July non-farm payrolls were 187,000 The Bureau of Labor Statistics report was lower than market expectations of 200,000, but still strong.

What Does the Data Add Up To?

At the June FOMC meeting, the consensus expressed in the “dot plot” was for two more rate increases in 2023. With the July increase behind us, attention may shift a bit from the actions of the Fed to an attempt to color in the outlines of the potential “soft landing.”

The phrase refers to bringing inflation back to the Fed’s target rate without tipping the economy over into recession. It’s notoriously difficult to achieve, and a more common outcome is for the Fed to overshoot on rates and then have to cut quickly and steeply as the economy teeters. But after eleven rate increases a still-strong labor market and healthy data indicators, along with positive consumer sentiment, are describing a durable economy.

The credit may not all be due to the Fed. It was late in raising rates, allowing inflation to build up a significant head of steam. The only reason that consumers did not suffer as deeply as might be expected with inflation peaking at 9.1% was the unprecedented stimulus passed during the pandemic. From unemployment benefits to tax cuts and credits, to stimulus checks, consumers were able to build a cushion of savings that helped mitigate the impact. Rising wages created by labor shortages also played a role.

With an economy driven by consumer spending, the health of the consumer cannot be understated in assessing future risk of recession. And for now, the consumer is feeling fine. The most recent reading by the Atlanta Fed’s GDPNow shows third quarter GDP estimated at a roaring 3.9%.

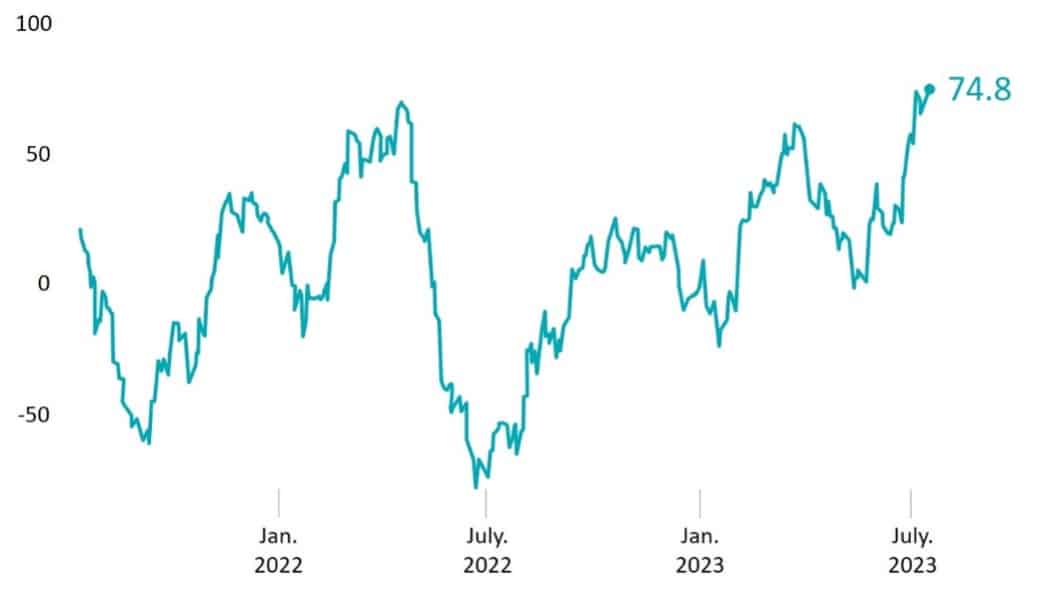

Chart of the Month: The Economy Is (Surprisingly) Better Than Expected

In mid-July, economic data hit the highest level of outpacing expectations in two years

CITIGROUP U.S. Economic Surprise Index

Source: Axios Visuals, Fact Set

Equity Markets in July

- The S&P 500 was up 3.11%

- The Dow Jones Industrial Average rose 3.35%

- The S&P MidCap 400 increased 4.05%

- The S&P SmallCap 600 posted 5.43%

Source: S&P Global. All performance as of July 31, 2023

All eleven S&P 500 sectors were up, as returns broadened. Energy was in the lead adding 7.28% for the month. Communication services was next, adding 6.74%. The top ten issues added 34.4%, significant compared to a few months ago when eight issues accounted for all the gains.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.96%, up only slightly from the prior month. The 30-year U.S. Treasury ended July at 4.02%. The Bloomberg U.S. Aggregate Bond Index returned -0.06%.

The Smart Investor

It’s the back half of the year. Some of the uncertainty around rates is resolved, the economy is looking up, and the equity markets are in positive territory.

The last days of summer are here, and back-to-school will start rolling through the country soon, starting in the South.

What should investors focus on?

- If you’re going to have to start paying back student loans in October, it’s time to start planning. Revisit your budget, and scale back where needed. Are you eligible for a repayment plan? How about refinancing?

- High rates are still with us. Are you taking advantage and moving cash balances into money markets or CDs?

- Fall means we are heading towards the end of the year. Make a list of the things you need to do in 2023 for tax or savings reasons: 401(k)s or IRAs, HSAs, and charitable giving should be at the top of your list.

Consumer confidence is likely not misplaced, but there’s still a ways to go before inflation is fully under control and the economy enters a new cycle. Keep your financial goals in sight, and ensure that your financial situation and goals are in sync with any big changes in your life.

![[Video] Q4 2025 Economic and Market Commentary](https://hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)