Help Your Workforce Reach Financial Success

With HUB FinPath, everyone has access to 1:1 financial coaches and powerful tools to help move from surviving to thriving.

Financial Success Begins Here

A study conducted by the American Psychological Association reveals that 70% of employees experience financial stress in the workplace, leading to increased absenteeism, higher turnover rates, and overall poorer health. This financial stress can arise from various situations, such as car accidents, natural disasters, medical emergencies, or even global pandemics.

At HUB RPW, we work with organizations of all sizes to provide employees access to personal financial coaches and money tools to move from surviving to thriving.

How it Works

Unlimited 1:1 Coaching

FinPath University Courses

Financial Health Tools

FinPath Program Perks

Coaching

Financial Coaching & Support Network

Truly setting FinPath apart from other programs is a large network of Wellness Coaches ready to help users navigate their financial journey.

Wellness Coaches do not work on commission and are completely unbiased—they are simply there to help. Sometimes it’s more convenient to speak with a real person who can explain things in a way that a video or learning module can’t.

Anywhere, anytime

Times have changed and so have we. Meet with a coach via phonelive video chat, or in person.

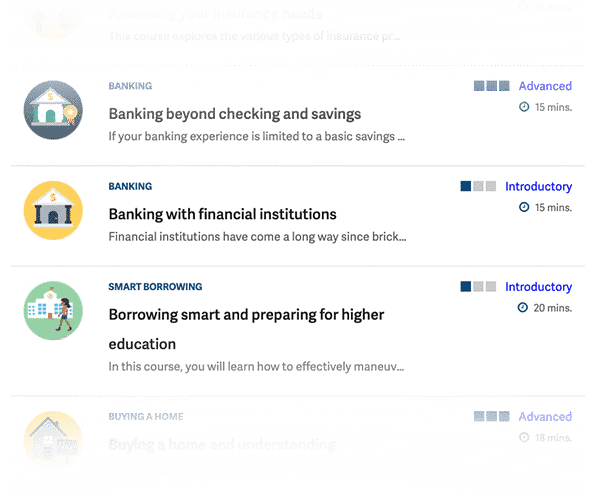

Courses

Step up your money skills with FinPath University

Courses are for everyone, no matter what sort of prior finance knowledge you have. Begin with our introductory 101 courses and progressively advance to more complex subjects. We simplify intricate financial concepts by relating them to common, real-life scenarios.

Popular courses this year:

- 5 Tips to Maximize Your Paycheck

- Credit is a Powerful Financial Tool – Use it to Your Advantage

- Manage Your Debt or Your Debt Will Manage You

- Student Loan Forgiveness

Financial Health Tools

Take action and track your progress with powerful financial wellness tools

With FinPath, you gain access to a comprehensive set of online tools that empower you to manage your finances effectively. FinPath encourages you to perform a series of goals to improve your financial wellbeing—like establishing emergency savings funds, improving credit score, lowering their debt, and more

From retirement, to vacations, to buying a home, we can help you project how much you need to save to accomplish every goal.

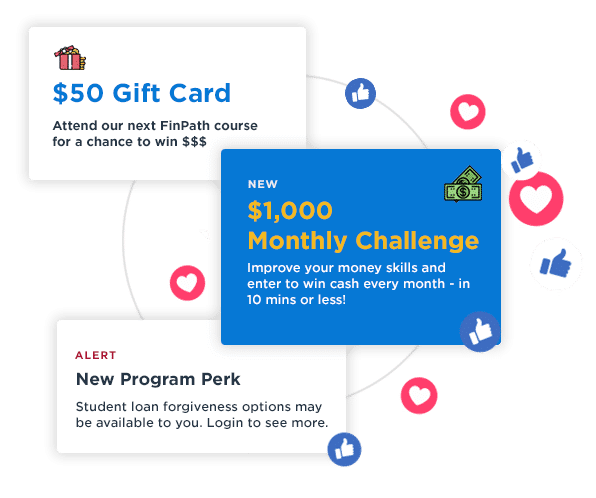

Program Perks

Get rewarded for improving your financial wellbeing

FinPath collaborates with a select group of preferred providers to offer you additional resources and benefits.

Current perks include:

- $1,000 monthly content

- Student loan forgiveness evaluations

- Identity protection and credit monitoring discounts

- Debt consolidation & emergency loans

- Nonprofit referral services

More coming soon!

Employers expect a turnkey experience. We deliver.

HUB FinPath is tailored to meet the specific needs of your staff, ensuring flexibility and adaptability. Our seamless onboarding process welcomes each new client, and our robust support system guarantees the program’s success. We handle all the details, making it effortless for your employees to develop better financial habits.

Dedicated Success Manager

Ongoing Engagement