Don’t StopFleetwood MacDon't Stop Don’t stop thinking about tomorrow / Don’t stop, it’ll soon be here December is often a difficult month for many people as they juggle the often-unrealistic expectations of the impending holiday season, the challenges of meeting...

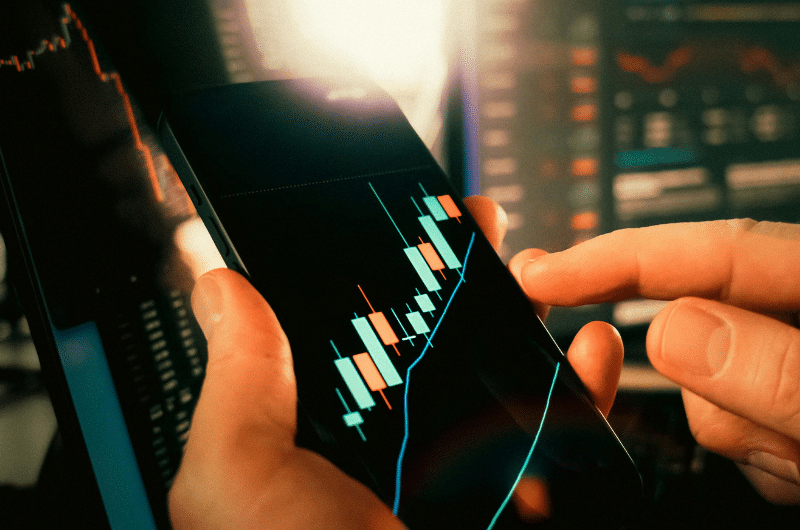

Read the latest market insights by the HUB Investment Research Team.

Market Commentary: December 2025 Recap

Don’t StopFleetwood MacDon't Stop Don’t stop thinking about tomorrow / Don’t stop, it’ll soon be here December is often a difficult month for many people as they juggle the often-unrealistic expectations of the impending holiday season, the challenges of meeting...

Market Commentary: December 2025 Recap

Don’t StopFleetwood MacDon't Stop Don’t stop thinking about tomorrow / Don’t stop, it’ll soon be here December is often a difficult month for many people as they juggle the often-unrealistic expectations of the impending holiday season, the challenges of meeting...

Markets Absorb Geopolitical Shock as Venezuela Events Unfold

On January 3, 2026, the United States executed...

Sign up for email updates

Subscribe to receive insights from our team delivered to your inbox once a month.

February Market Commentary: A New Administration Gets Down to Business

A New Administration Gets Down to Business January Recap and February Outlook January seemed to go on forever, as the country faced extreme weather and devastating wildfires [1]. The new administration got underway with a lot of sound and fury, particularly around...

2025 Roundtable Summary

January Market Commentary: Seems Like Old Times?

Seems Like Old Times? December Recap and January Outlook The inauguration of only the second U.S. president to win two non-consecutive terms (Grover Cleveland was the first) is historic by a host of measures. Starting a second term of office with the president’s party...

December Market Commentary: A New Regime Comes Into Focus

A New Regime Comes Into Focus November Recap and December Outlook The transition to a new administration is underway with announcements of cabinet position nominees. The pro-business lean of the incoming government is not a surprise, and the emphasis is likely to be...

November Market Commentary: A Historic Election Removes Some Uncertainty

A Historic Election Removes Some Uncertainty October Recap and November Outlook An election season with several twists and turns came to a clear end with the decisive reelection of President Donald Trump. The received wisdom is that the financial markets hate...

October Market Commentary A Volatile Start to the End of the Year?

A Volatile Start to the End of the Year? September Recap and October Outlook September equity markets ended the month in positive territory, but with volatility increased. The VIX, the markets “fear index” closed higher than last month, at 16.73, up from 15.00....

Investment Research Team

Brian Collins

Chief Investment Officer

Daren Alcantar

VP, Investment Strategy & Analytics, Global Retirement Partners

Jay Sanford

Director – Investment Strategy

Cameron Cooke

EVP Investment Consulting

Christopher Wright-Madison

Sr. Analyst, Research Investment

Justin Fisk

Senior Vice President, Investment Services

Tom Phan

Vice President of Investment Strategy

Patrick Maynor

Equity Portfolio Manager

Eric Light

Director of Operations and Trading