February Recap and March Outlook

If there’s an aphorism for February that you could embroider on a pillow, it would be, “The more things change, the more they remain the same.” Markets appear to have finally started taking Federal Reserve Chairman Jerome Powell’s warnings seriously and caught up to the rhetoric that the Fed has been consistently pushing out. Rates will be higher for longer, yields went up, bond prices fell, and equity markets finally acknowledged that the pivot was nowhere in sight.

What does this mean for the economy? The labor market remains strong, and inflation is proving as stubborn this year as last year – despite unprecedented rate hikes in 2022. This means that the Fed has even less room to maneuver a soft landing.

Let’s get into the data:

- 12-month CPI was 6.4% in January. The Bureau of Labor Statistics reported a monthly increase of 0.5%, the most in three months. The annual number marked the seventh consecutive decline in inflation, but by only 0.1%, showing decreases in CPI slowing down considerably.

- Consumer sentiment hit 66.4. The University of Michigan’s preliminary February reading on the overall index of consumer sentiment was the highest in 13 months, surprising consensus expectations.

- Consumer confidence was down slightly to 87.5. The Conference Board’s measure is an expectations index that captures the short-term outlook for the economy. Consumers remain pessimistic about inflation.

What Does the Data Add Up To?

Consumers appear to be correctly assessing the situation. The labor market remains strong, and they feel confident in the longer term, but they see no real relief in prices in the short term.

The question is, why not? After massive and quick rate hikes in 2022, it looks like we are in for at least three more hikes in 2023, likely adding another 75 basis points to the key short-term Fed Funds rate.

Layoffs, particularly in tech sectors, continue to be announced. While these make headlines, they aren’t enough to soften the overall labor market and instead still seem to be the result of post-pandemic over-hiring flushing through the system.

Why aren’t rate hikes working? People (mostly economists) have a lot of theories. The Fed’s one seems to be that they aren’t working yet. Another possibility is that government spending, while certainly lower than in the pandemic, is still nowhere near austerity levels. And finally, there’s always “It’s the boomers’ fault.” Social security payments increased by a whopping 8.7%, which may be contributing to the rise in consumer spending.

The Fed released the Semi-Annual Monetary Policy report on March 3, and Chairman Powell will be testifying before Congress on March 7-8. Recent speeches have indicated that the worry is that the strong growth and disappointing inflation data in the first months of the year may be more than a fluke that will correct as rate hikes already enacted continue to put downward pressure on the economy.

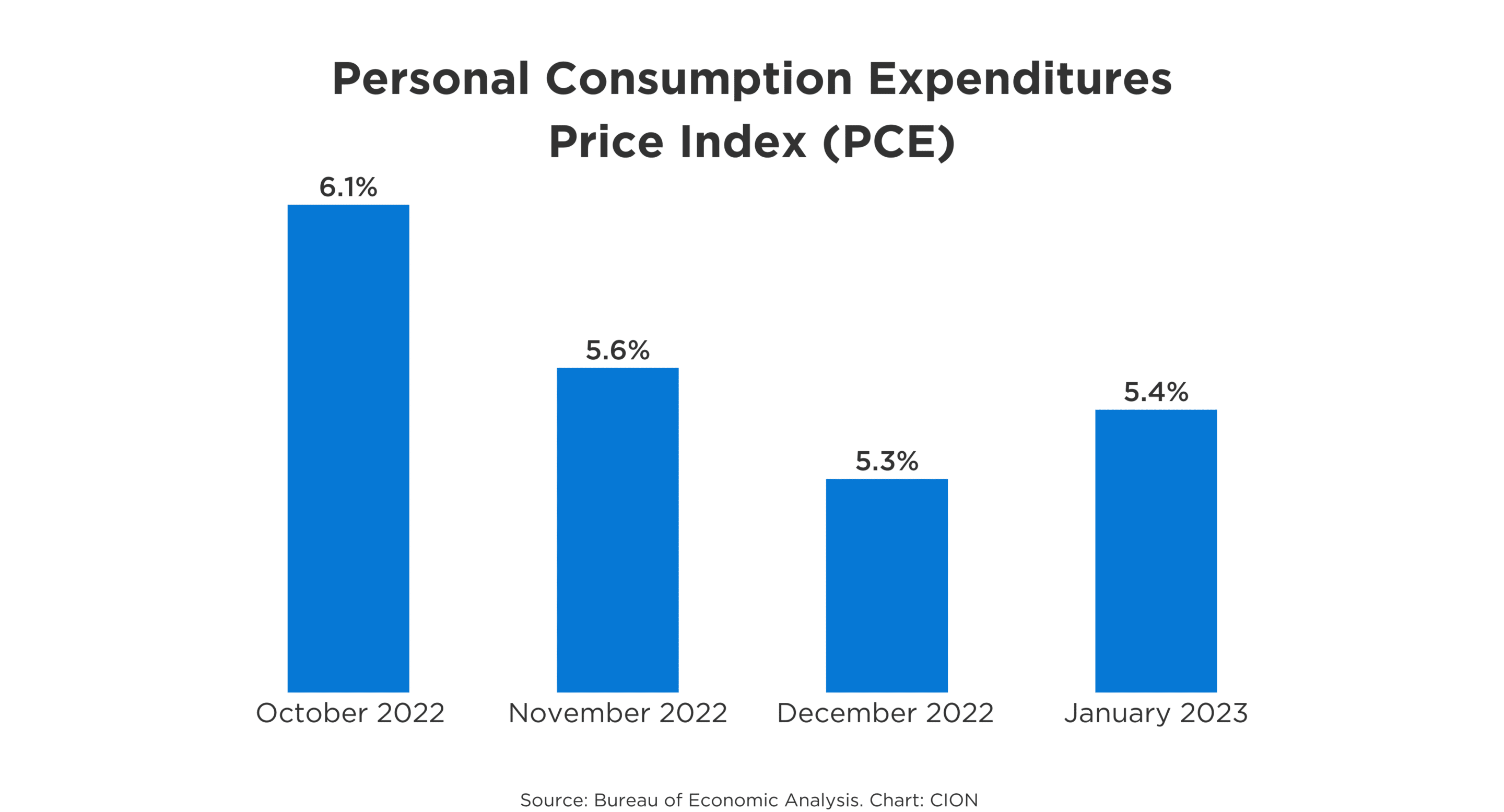

Chart of the Month: The Fed’s Preferred Measure of Inflation Increased

Inflation fell throughout the Autumn, but the rate of decrease declined each month, and in January, inflation trended back up. This is exactly the situation Powell has been concerned about, as the labor market remains strong and wages are increasing.

Equity Markets in February

- The S&P 500 was down 2.61%

- The Dow Jones Industrial Average fell 4.19%

- The S&P Mid-Cap 400 decreased 1.95%

- The S&P Small-Cap 600 dropped 1.35%

Source: S&P. All performance as of February 28, 2022

The January rally reversed as only one of eleven sectors gained. Information Technology was the stand-out performer with a just-barely-positive result of 0.29%. Earnings season for 4Q is largely complete, with 480 issues reporting and 67.3% beating estimates on earnings and 65.3% beating estimates on sales. As a whole, Q4 2022 is expected to be down 1.7% from Q3 2022.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.93%, a sharp increase from 3.50% in January as equity markets declined and investors moved to a more risk-off stance. The 30-year U.S. Treasury ended February at 3.92%, up from 3.63% last month. The Bloomberg U.S. Aggregate Bond Index ended February down 2.58%. The index continued the trend of positive correlation between the equity and bond markets.

The Smart Investor

We’ve spent the last several years with the markets reacting – and overreacting – to data from every corner of the economy.

That’s not likely to change, but as an investor, a better approach may be to focus more on goals than gains. As we enter tax season, it’s a good idea to rethink your tax strategies and see if there are ways you can maximize your tax efficiency for next year.

There are some tactical things you may want to think about:

- Asset prices are still low. Roth conversions remain an effective strategy to create tax-free income in retirement and simplify estate planning

- We’re still in for volatility. Diversification across asset classes is one of the few ways to insulate your portfolio. With the broad swing in asset values, your portfolio may have moved from the guidelines you set up. For both taxable and retirement accounts, it’s a good idea to review your allocations, even if looking at your overall balance is unpleasant.

Being very clear about your goals can help you ride out market uncertainty and volatility. What do you want to get from your investments in the next five, ten, or twenty years? How do you want your life to look? Taking the time to reset goals and ensure that your financial plan is on track can keep you focused and invested, so when the market turns, you’re there to capture the gains.

![[Video] Q4 2025 Economic and Market Commentary](https://hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)