Investment markets in the last three weeks have experienced heightened levels of volatility and reversals caused by multiple factors including the Trump administrations’ aggressive actions on tariffs and trade matters; the shift in foreign policy, particularly related to the war in Ukraine; and the collective impact on expectations for market growth and inflation. This information is to help put some context around what has been occurring over the last few weeks.

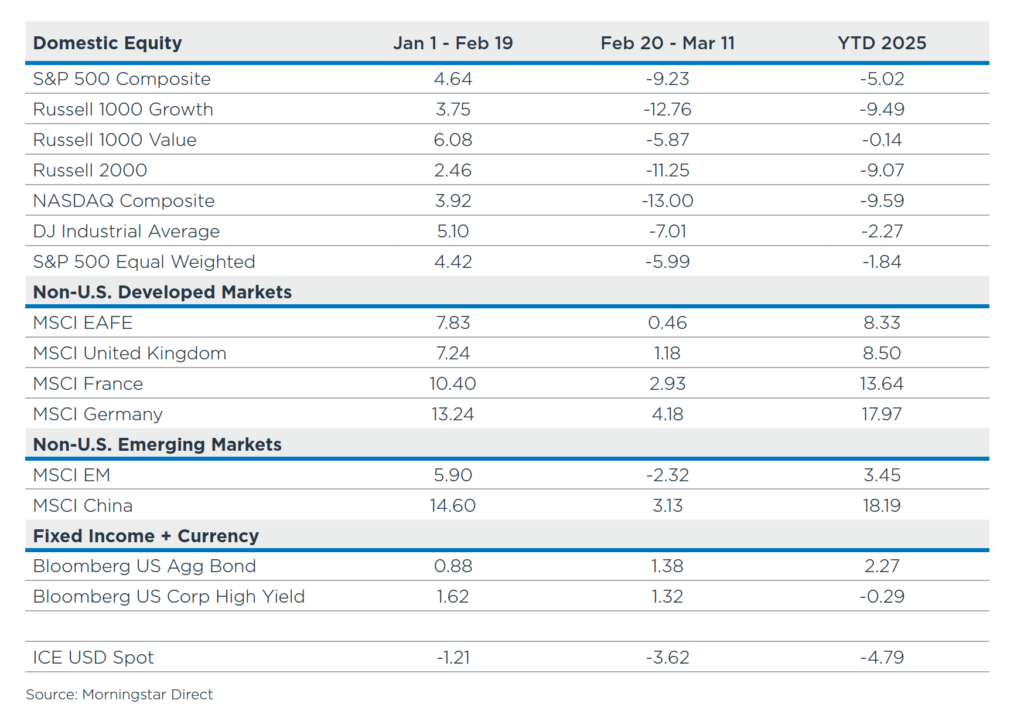

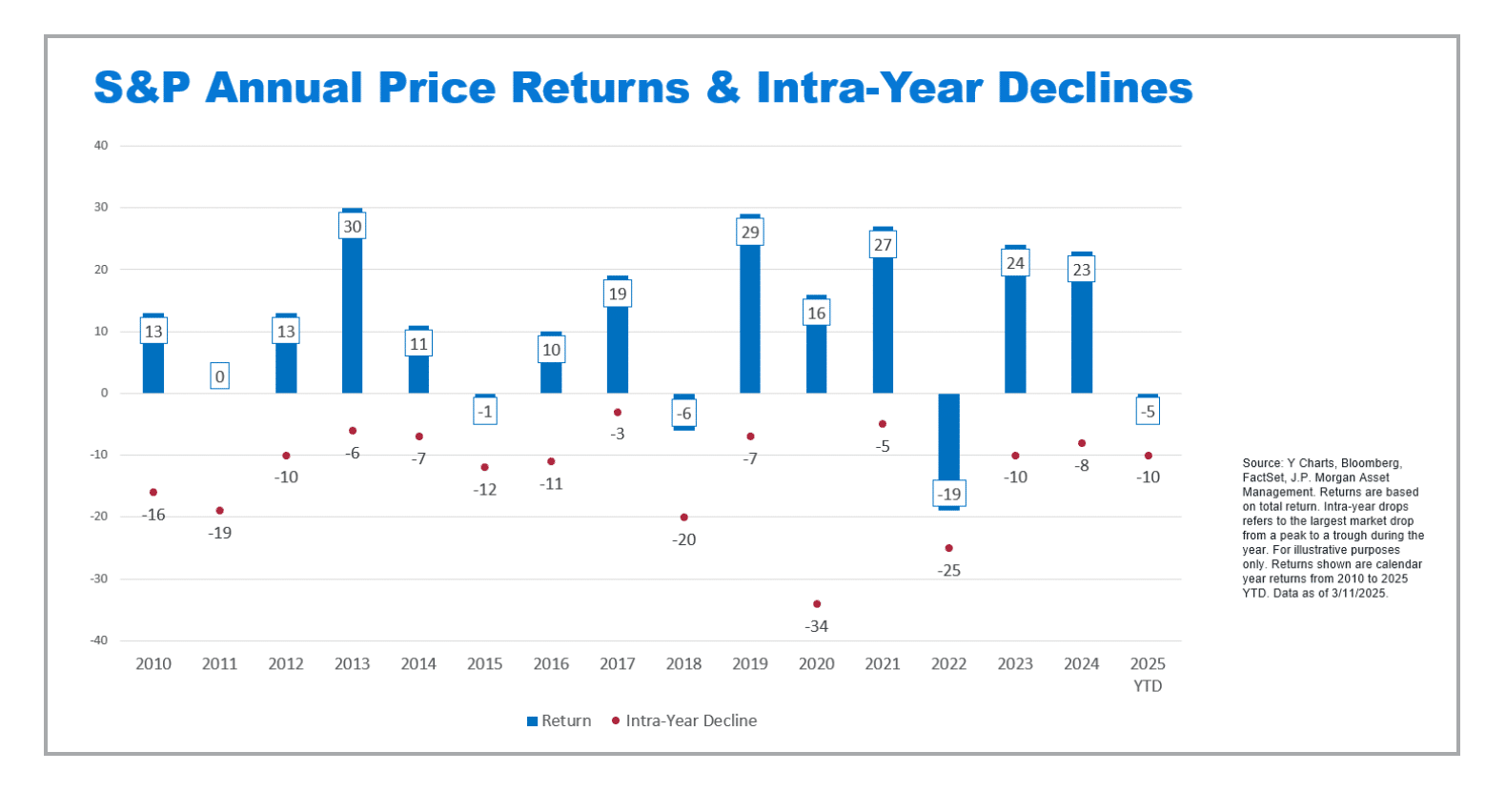

- The S&P 500 has not had a 10% downswing in well over a year. Current returns have been close to this 10% threshold in recent days.

- 10% downdrafts are common and typically occur at least once per year, historically. (See the graphics on the following pages)

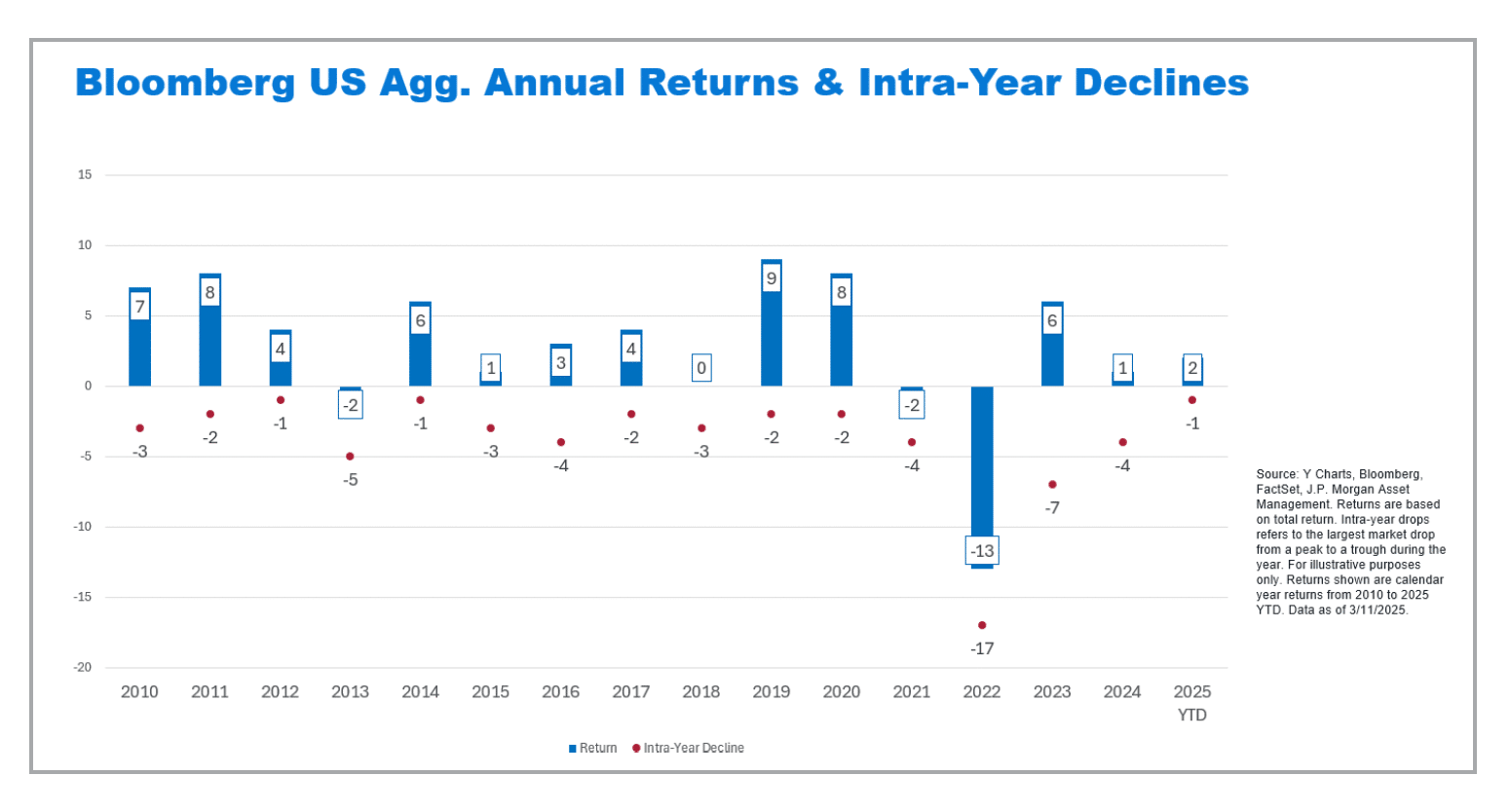

- In general, bonds have been positive through this recent equity volatility and are positive YTD.

- Many non-US equity markets across different regions have rallied and held up better than domestic equities this year.

- Value indices have held up better than growth on a relative basis while small cap stocks have declined more than large cap.

- In short, diversification has worked in 2025.

While a three-week period does not make a year and as noted above the S&P often declines 10% intra year, it can be helpful to look at what has led to full year market declines of 10% or more in past calendar years. Historically speaking, negative double-digit annual losses in the S&P500 are the result of:

Severe recessions

The February jobs report showed 151k jobs added with unemployment rate at a healthy 4.1%. The current data does not point to a severe recession in the near-term however some recent economic data has started to signal a slowing, leading many companies to cut Q1 guidance. Current analyst earnings estimates for the back half of 2025 are still projected to be near all-time highs for the S&P500 though the market is starting to grapple with the probability that these earnings estimates will need to come down if sentiment does not improve drastically.

Significant policy mistakes

One could make the argument that the everchanging tariffs policy is being interpreted as a policy mistake by the markets. Investors are seeking to find the pain point of the current administration on their policy mix (spending cuts + tariffs). Investors may not have initially priced in the full weight of tariffs as the consensus was that they would be used as a negotiating tactic as opposed to a prolonged trade war. So far, responses to and from actions taken by Canada and Mexico show that the uncertainty around trade policy and its implications on investment markets will likely continue for the foreseeable future.

All eyes will remain focused on the latest CPI data. Both Headline CPI and Core CPI results released today showed a small decline and came in below estimates. However, the price impacts of tariffs are not captured in this month’s results. Future CPI measures are likely to show how prices have reacted to rising tariffs on segments of the US economy. An uncertain inflation picture further complicates the Fed’s progress towards lowering interest rates towards its target level. Higher inflation caused in part by tariffs mixed with potential increases in unemployment if the economy does slow will challenge the Fed.

In summary, investment markets have been volatile in recent weeks for many reasons, some of which may have more persistence through 2025 while others may fade in importance in the coming months. Finding the right balance between accounting for recent volatility and staying focused on long-term investment goals and plans are important drivers of investment success. The following graphics highlight that in the short-term, investment market performance can be volatile and swing on sentiment more than fundamentals. Looking at longer-term results, the S&P 500 has performed well year over year since 2010 though in almost every year there has been a sizeable downturn. While in recent years fixed income has not always provided favorable diversification, the bond market as represented by the Bloomberg Aggregate index does help dampen overall portfolio volatility.

![[Video] Q4 2025 Economic and Market Commentary](https://hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)