‘Cause, everything’s right / So just hold tight

This crazy world / It turns, it turns

Everything’s Right

Phish

Back in June, the song for the Q2 commentary was the Beach Boys “Good Vibrations”, appropriate given the strong finish to the quarter after the brief Tariff Tantrum in early April. A return to market normalcy, with large cap stocks pushing to all-time highs, was welcomed as summer rolled forward. Over the course of the third quarter, investors worked through a few twists and turns. Signs pointed to a potentially weakening labor market coupled with inflation measures no longer declining as tariff talks continued to threaten economic relationships. Fed watchers eventually were pleased that the FOMC determined a rate cut in September would be supportive for the economy without fueling more inflation. With a foreshadowing in August, investors already had priced in the 25 basis points cut and were focused on what may still occur in Q4.

Swirling around the markets all quarter were geopolitical tensions flaring across the globe and domestic policy battles around immigration, Fed independence, and conflicting political agendas. This all seemed to matter little to investors who were pleased to see equity markets hit multiple new highs while bonds posted positive returns and offered attractive yields. The biggest surprise was the 12% rally in US small caps that beat large caps by 4% during the quarter. Expectations for lower interest rates, a renewed focus on domestic growth, and undervaluation relative to large caps pushed investors to bid up small cap stocks. Non-US stocks did cool off after a torrid start to the year, though YTD returns remain well above the S&P 500. Emerging market stocks, led by China, Korea, and Taiwan, have generated market leading returns due to shifts in currency markets and their domestic responses to the US tariffs. Reflecting the many uncertainties faced by global investors, gold prices rose close to 50% YTD outpacing Bitcoin’s 22% increase.

Looking back over Q3, there is much to like about how things have played out across different markets. Investors are also nervous as shown in recent sentiment metrics. Good investors live with a balance between their optimism and their doubts. Corporate fundamentals and earnings are strong across many sectors, and consumer balance sheets remain solid, though mortgage rates may still be too high to spur more housing activity. And, the Fed has room to lower rates again if needed to keep the economy from slowing. Will these positives be enough to offset concerns about trade and tariff impacts, immigration policy shifts impacting jobs and prices, and the continuing geopolitical tensions around the globe? Add in the US government shutdown and it is not surprising there is some uncertainty heading into Q4. In the current market environment, it is healthy to be positive about recent market performance and nervous about what is ahead. Investors who ride too high or stay too low often lose sight of their long-term goals that should guide them on their investment journey. It may be hard “’cause everything’s right” at this moment but “just hold tight” because “this crazy world, I know it turns, it turns.”

Here are observations on what occurred across the investment markets in Q3:

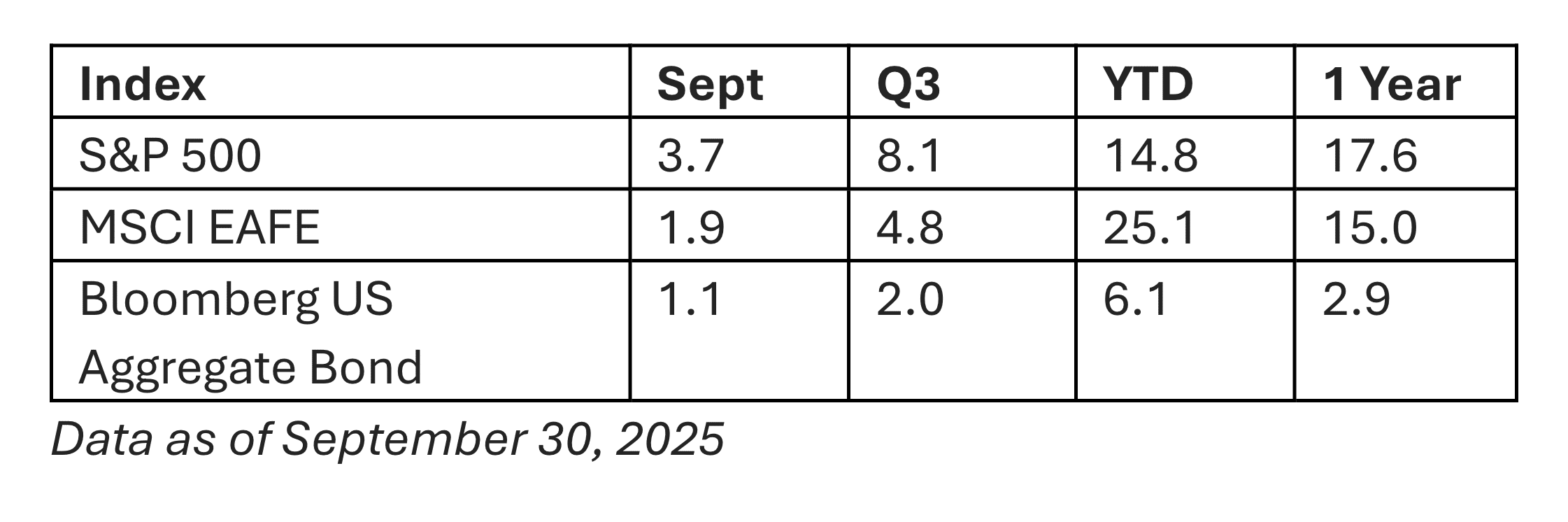

Broad Market Performance1

Domestic Equity2

- US equity markets were positive in September, with broad participation though mega cap stocks led the rally for the month and the quarter.

- Building on strong returns in August, small cap stocks performed well in September. Multiple sectors in the Russell 2000 were up 16+% in the quarter, with Industrials benefitting from a rotation towards domestic economic growth.

International and Global Equities3

- Non-US developed market stocks were positive in September but lagged the strong US equity markets. YTD, MSCI EAFE is well ahead of the S&P500 due to its strong start to 2025.

- China, Taiwan, and Korea were the big performers in the emerging markets index, which outperformed the US for the month, quarter, and YTD

Fixed Income Markets4

- US bond markets took the Fed rate cut in stride, having priced in the move well in advance. Interest rates fell 5-10 bps over the quarter while bond spreads narrowed slightly, resulting in positive returns across most sectors for the month and quarter.

Specialty Markets5

- REITs lagged bonds and broader equity markets as investors favored higher growth segments and corporate bonds for yield. Commodities were mixed with oil and gas prices down but gold and other precious metals rallying through the quarter.

Sectors6

- Growth sectors (IT and Comm Services) rallied on aggressive AI spending, pushing broad indices to new highs. Consumer Staples and Materials were the two negative sectors for the month.

If you have questions or want to discuss the current state of the investment markets and their impact on your plan or portfolio, please do not hesitate to reach out to your advisor—they are here to help. It can be a challenge to find the right balance between the optimism that comes from strong market performance and the concerns about top heavy markets cresting over. So “hold tight, this crazy world turns.”

1-6 All data referenced in the table and comments supplied by Morningstar as of 9-30-2025

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from HUB International or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professionals, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for informational purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

HUB Retirement and Private Wealth employees are affiliated with and offer Securities and Advisory services through various Broker Dealers and Registered Investment Advisers, some of whom may or may not be affiliated with HUB International. HUB International owns the following Registered Investment Advisers: HUB Investment Partners; HUB Investment Advisors; GRP Financial; RPA Financial; and Taylor Advisors. Additional information for each individual HUB International Registered Investment Advisor may be found in the respective Form ADV available on the SEC’s IAPD website at adviserinfo.sec.gov. Insurance services are offered through HUB International.

![[Video] Q4 2025 Economic and Market Commentary](https://hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)